Homeownership Affordability in Virginia (2004)

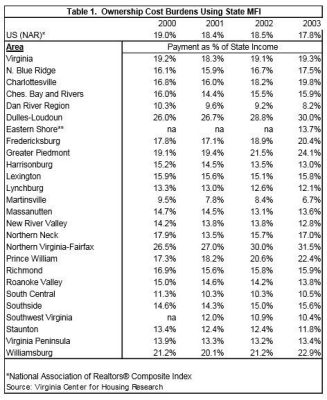

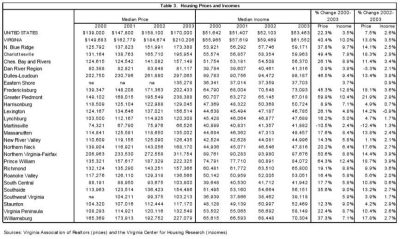

Despite much more rapid increases in housing prices than incomes, the median house sold (excluding most new construction) remains affordable to the median family in the state. In addition, the median house remains affordable to the median family within every VAR market area of the state. Although the average Virginian cannot afford to buy the median house in Northern Virginia-Fairfax and Dulles-Loudoun, the average family in Northern Virginia can.

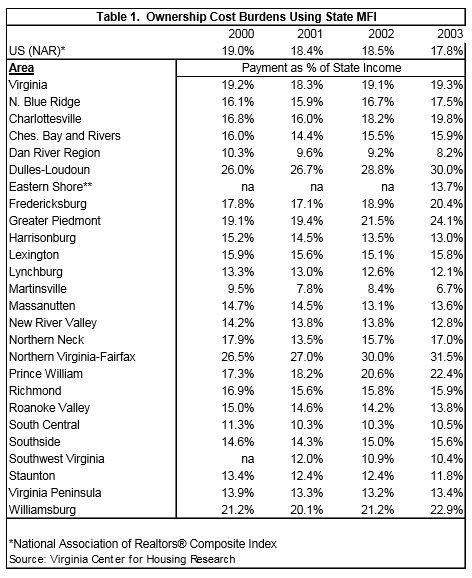

Housing prices have remained affordable in large part because of low interest rates. The cost burden for the median price house in 2003 would have been 25%, if interest rates had stayed at the same level as in 2000 (or rise to that level in the future). This is a level that clearly threatens the affordability of housing for many families in the state. Housing prices throughout Northern Virginia, Fredericksburg, Charlottesville, Greater Piedmont, and Williamsburg would be unaffordable to most of Virginia’s families, including many of the families living in these areas.

Housing prices cannot continue to increase at their recent pace without endangering the broad affordability of housing within the state. Incomes have lagged behind housing prices by a dangerous margin and are unlikely to catch up unless the increase in housing prices slows substantially. Moderate increases in interest rates will undoubtedly dampen the frenzied pace in housing prices. A significant increase in interest rates, however, would quickly expose the state’s housing affordability problem and could cause serious dislocations in the housing market, particularly in the Northern Virginia-Fairfax, Dulles-Loudoun, Fredericksburg, Charlottesville, Greater Piedmont, and Williamsburg market areas.